REVERSE VESTING: A MECHANISM THAT HELPS RETAINING FOUNDERS

Yair Udi

Yair Udi

January 10, 2023

January 10, 2023

As we have already discussed in our previous publications, the process of raising investments to a company may require several...

Read More

Double Trigger on Option [Vesting] Acceleration – Meaning and Importance

Yair Udi

Yair Udi

October 19, 2022

October 19, 2022

Share or option vesting is a retention mechanism, intended to secure the engagement of founders, employees, and advisors, over time...

Read More

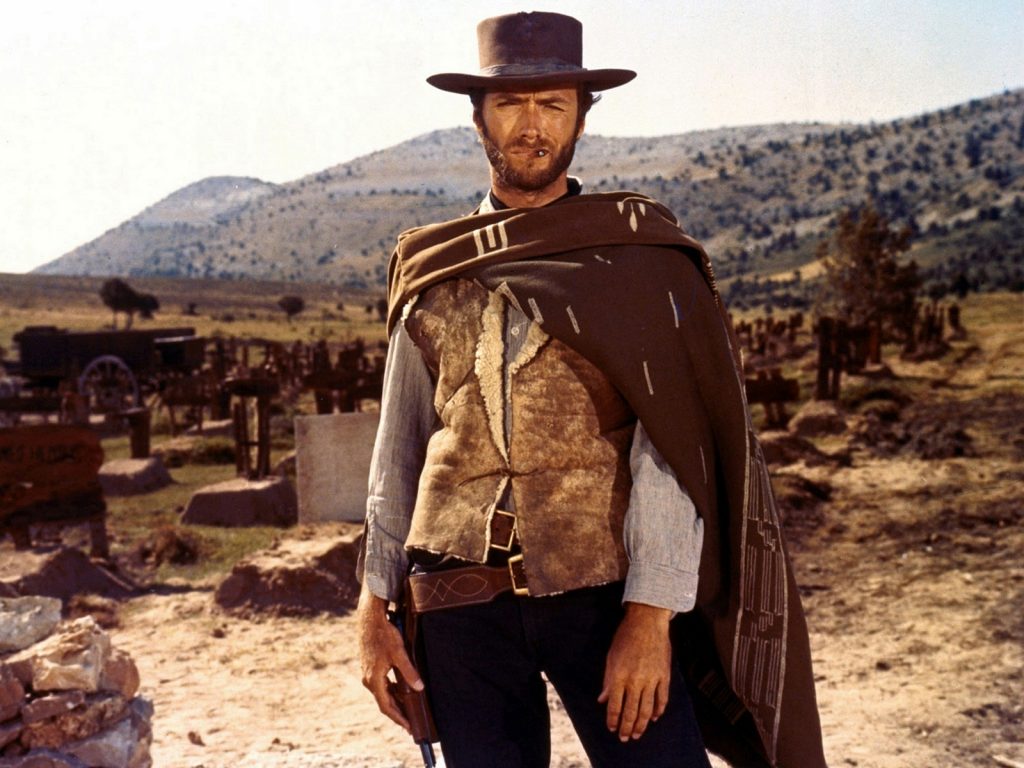

Anti-Dilution – The Good, the Bad and the Ugly

Yair Udi, Adv.

Yair Udi, Adv.

September 15, 2022

September 15, 2022

Shares that are sold by a company, usually in the case of issuance, result in existing investor-holding dilution, unless they...

Read More

Liquidation Preference: Meaning and difference between “participating” and “non-participating” liquidation preference

Yair Udi

Yair Udi

July 13, 2022

July 13, 2022

Investors purchasing preferred stock, usually demand to have a liquidity preference mechanism, whereby their purchased stock is being cashed out...

Read More

Right of Co-Sale

Yair Udi

Yair Udi

July 5, 2022

July 5, 2022

Right of First Refusal and Co-Sale Agreement is one of the standard transaction agreements executed in the framework of a...

Read More

Purpose of Valuation Cap in SAFE

Yair Udi

Yair Udi

June 27, 2022

June 27, 2022

SAFE is an agreement used by startups mainly to raise funds during their seed financing rounds. By using a SAFE,...

Read More

No Shop Provision in Term Sheet and its Implications

Yair Udi

Yair Udi

June 19, 2022

June 19, 2022

A term sheet outlines the rights and obligations of parties involved in private equity transactions. Generally speaking, most term sheets...

Read More

Why Breakup Fee clauses needed in M&A transactions?

Yair Udi

Yair Udi

June 8, 2022

June 8, 2022

Breakup fee clause, also known as “termination fee” clause, is often included in the Letter of Intent, a Memorandum of...

Read More

![Double Trigger on Option [Vesting] Acceleration – Meaning and Importance](https://yairudi.com/wp-content/uploads/2022/08/INVESTMENT-TIPS.jpg)